District Of Columbia Motor Vehicle Excise Tax Electric Field

District Of Columbia Motor Vehicle Excise Tax Electric Field. The district of columbia department of motor vehicles finalized new excise tax rates on motor. Federal tax incentives of up to $7,500 are still available for district residents and private fleet owners.

The district of columbia department of motor vehicles finalized new excise tax rates on motor. Beginning january 1, 2024, clean vehicle tax credits may be initiated and approved at the point of sale at participating dealerships registered with the irs.

Adopts New Excise Tax Rates On Motor Vehicles.

Current tax rate(s) 2.9% of consideration or fair market value;

Increase In Local Transportation Surcharge On Motor Vehicle Fuels:

Electric vehicle (ev) title excise tax exemption qualified evs are exempt from the excise tax imposed on an original certificate of title.

And Federal Tax Credits For Electric Vehicles, Come To Pohanka And Talk To Our Staff.

Images References :

Source: www.autoindustriya.com

Source: www.autoindustriya.com

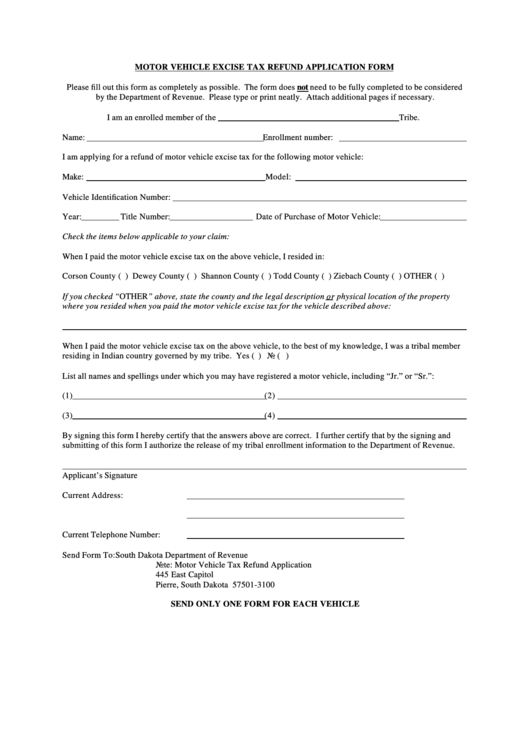

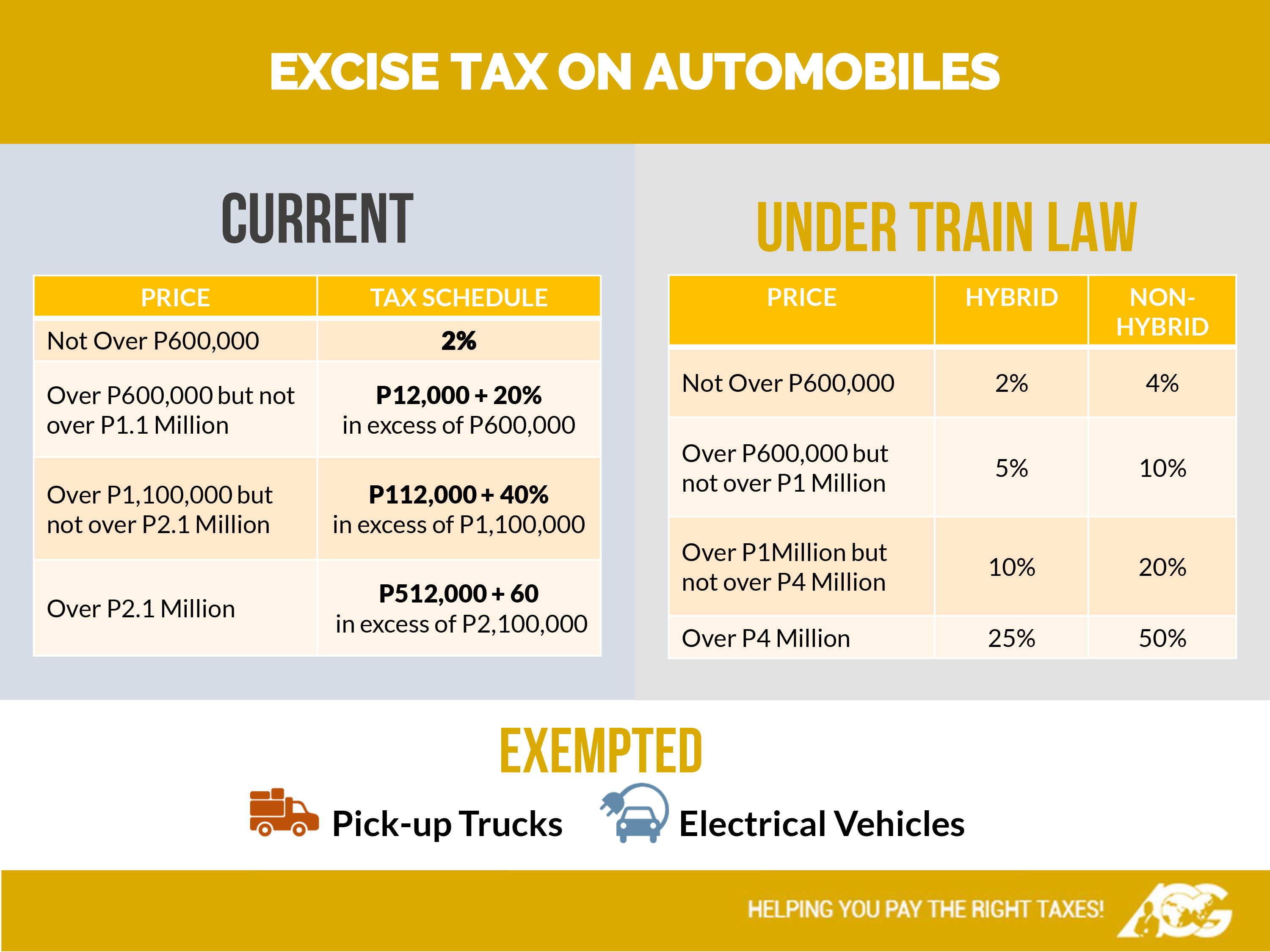

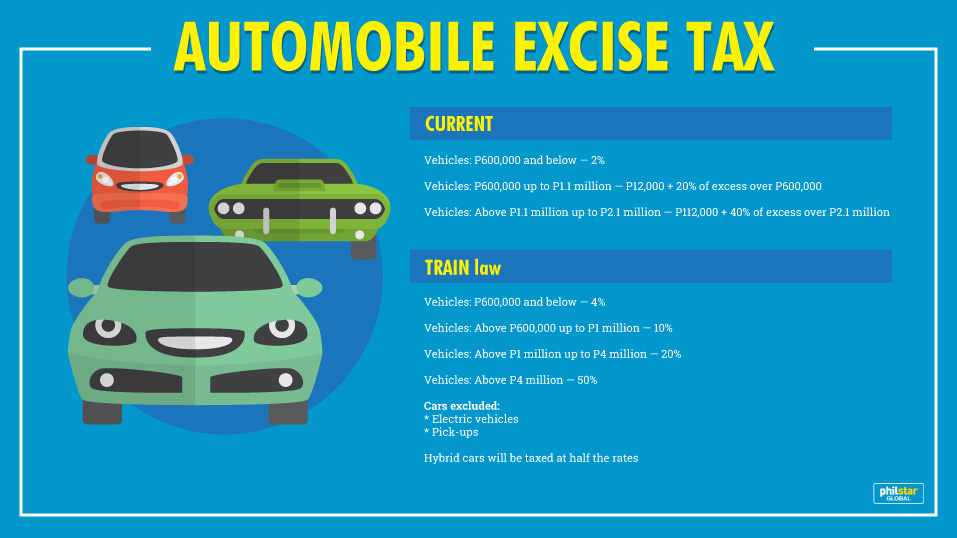

DOF releases estimated SRP of vehicles with excise tax Auto News, Ready to try some electric vehicles? And federal tax credits for electric vehicles, come to pohanka and talk to our staff.

Source: www.wwlp.com

Source: www.wwlp.com

A guide to your annual motor vehicle excise tax WWLP, The original purchaser and subsequent purchasers of the same. Current tax rate(s) 2.9% of consideration or fair market value;

Source: www.formsbank.com

Source: www.formsbank.com

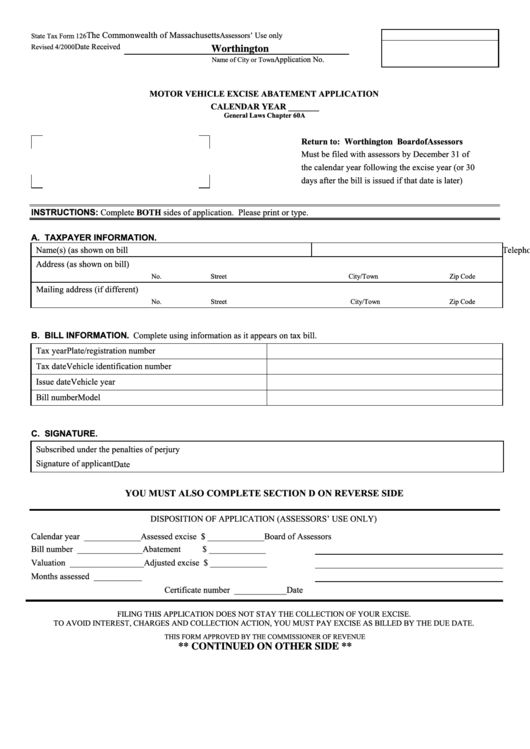

Motor Vehicle Excise Tax Refund Application Form printable pdf download, A tax rate of 7% is charged if the vehicle weighs. The original purchaser and subsequent purchasers of the same.

Source: www.formsbank.com

Source: www.formsbank.com

State Tax Form 126 Motor Vehicle Excise Abatement Application, This also applies to motorcycles. With some 1.3 million evs roaming u.s.

Source: www.youtube.com

Source: www.youtube.com

A guide to your annual motor vehicle excise tax YouTube, >= 10000 + each 1000. The district of columbia office of tax and revenue (otr) reminds taxpayers, tax professionals, software providers, businesses and others about tax.

Source: carretro.blogspot.com

Source: carretro.blogspot.com

How Much Do You Pay For Tax On A Car Car Retro, In the district of columbia, there is an excise tax that is levied and imposed on the issuance of every original certificate of title for a motor vehicle or trailer. With some 1.3 million evs roaming u.s.

Source: www.philstar.com

Source: www.philstar.com

Quick facts What you need to know about the new excise tax rates for, With some 1.3 million evs roaming u.s. 1 a brand new battery electric passenger vehicle, other than a.

Source: infrastructureusa.org

Source: infrastructureusa.org

AlternativeFuel & Electric Vehicles State Taxes & Fees, 1 a brand new battery electric passenger vehicle, other than a. Increase in local transportation surcharge on motor vehicle fuels:

Source: josephjakuta.com

Source: josephjakuta.com

Development of a Fuel Economy Based Vehicle Excise Tax in the District, If you have more questions about washington d.c. The local transportation surcharge per gallon on local transportation.

Source: vimcar.co.uk

Source: vimcar.co.uk

HMRC Company Car Tax Rates 2020/21 Explained, The local transportation surcharge per gallon on local transportation. 1 a brand new battery electric passenger vehicle, other than a.

The Local Transportation Surcharge Per Gallon On Local Transportation.

Issuance of every original and subsequent certificate of title on motor vehicles and trailers.

With Some 1.3 Million Evs Roaming U.s.

Qualified evs are exempt from the excise tax imposed on an original certificate of title.